Luke Lango and the InvestorPlace team have launched a new promotional campaign for Innovation Investor featuring something called the “fourth divergence.”

By subscribing to Innovation Investor today, you get a bundle of reports, eBooks, and guides explaining how to take advantage of a rare divergence in today’s stock market – including specific stocks to buy today.

Should you subscribe to Innovation Investor? How does the fourth divergence work? Keep reading to discover everything you need to know about Luke Lango’s Innovation Investor today in our review.

What is Innovation Investor?

Innovation Investor is a monthly newsletter led by Luke Lango. In exchange for an annual subscription fee, investors receive stock recommendations, market analysis, bonus reports, investment guides, and more.

With Innovation Investor, Luke Lango focuses on upcoming tech trends. The goal is to help investors get in on the ground floor of explosive new trends.

Some of Innovation Investor’s recent topics of focus have included autonomous vehicles, blockchain technology, and supercomputing.

By subscribing to Innovation Investor today, you can be the first to hear about new technologies, innovations, and breakthroughs that could change the world. By investing in the right elements of these technologies today, you could earn huge potential returns on investment.

What is the Fourth Divergence?

As part of a 2022 marketing campaign for Innovation Investor, Luke Lango and the InvestorPlace team have launched a presentation discussing the fourth divergence.

Here’s how Luke introduces the fourth divergence and its potential opportunity for investors:

“The last three times this rare pattern emerged, multiple stocks doubled within 12 months – during the worst bear markets in U.S. history.”

We may be entering a bear market, but investors could still make money by paying attention to this fourth divergence. Market volatility presents an opportunity for investors. Even as markets are sliding, some stocks will generally go up.

In fact, Luke Lango claims to have discovered a group of stocks he believes will skyrocket because of market uncertainty:

“You see, what most folks don’t realize is that certain stocks are set to explode not in spite of all the market uncertainty we’re seeing, but because of it.”

We’re in the middle of the fourth divergent event today. The first three divergent events occurred during the 1987 crash, the 2008 recession, and the 2020 crash. Today, Luke Lango believes we’re in the middle of the fourth divergence, which creates a huge opportunity for investors.

How Divergences Work

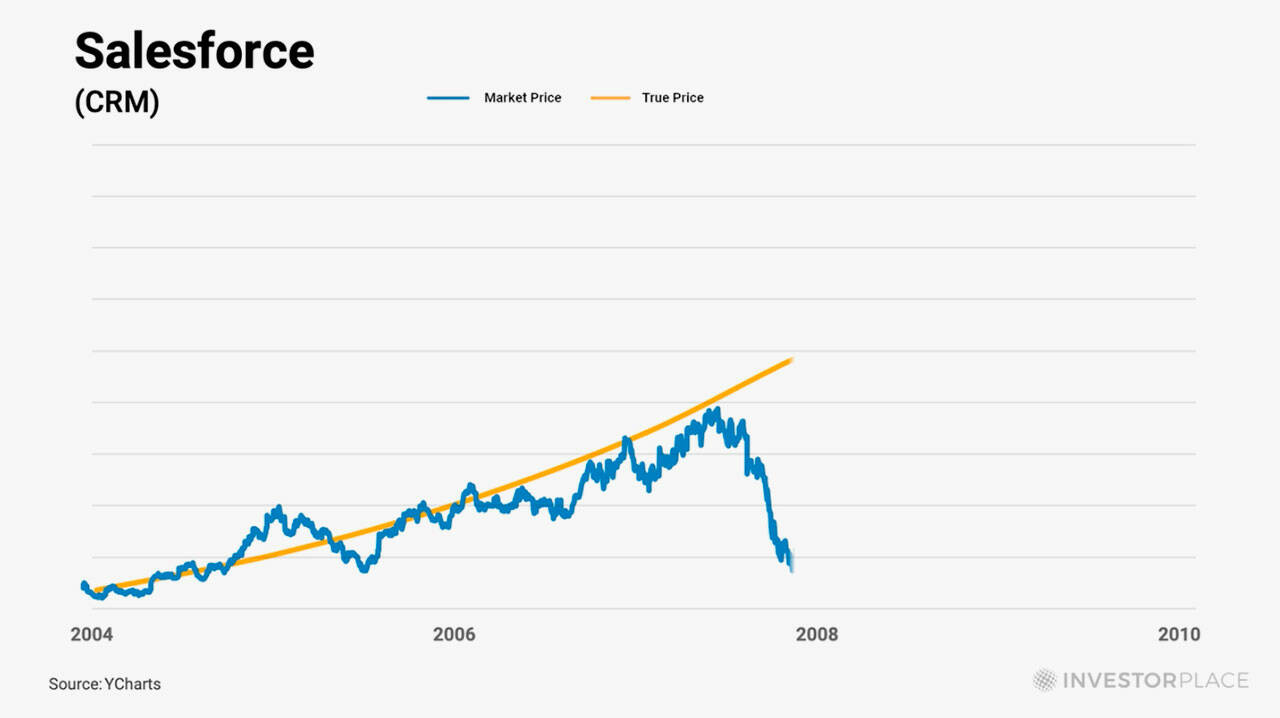

Luke Lango believes bear markets create a divergent in stock prices. As markets fall, some good stocks get dragged down below their true value.

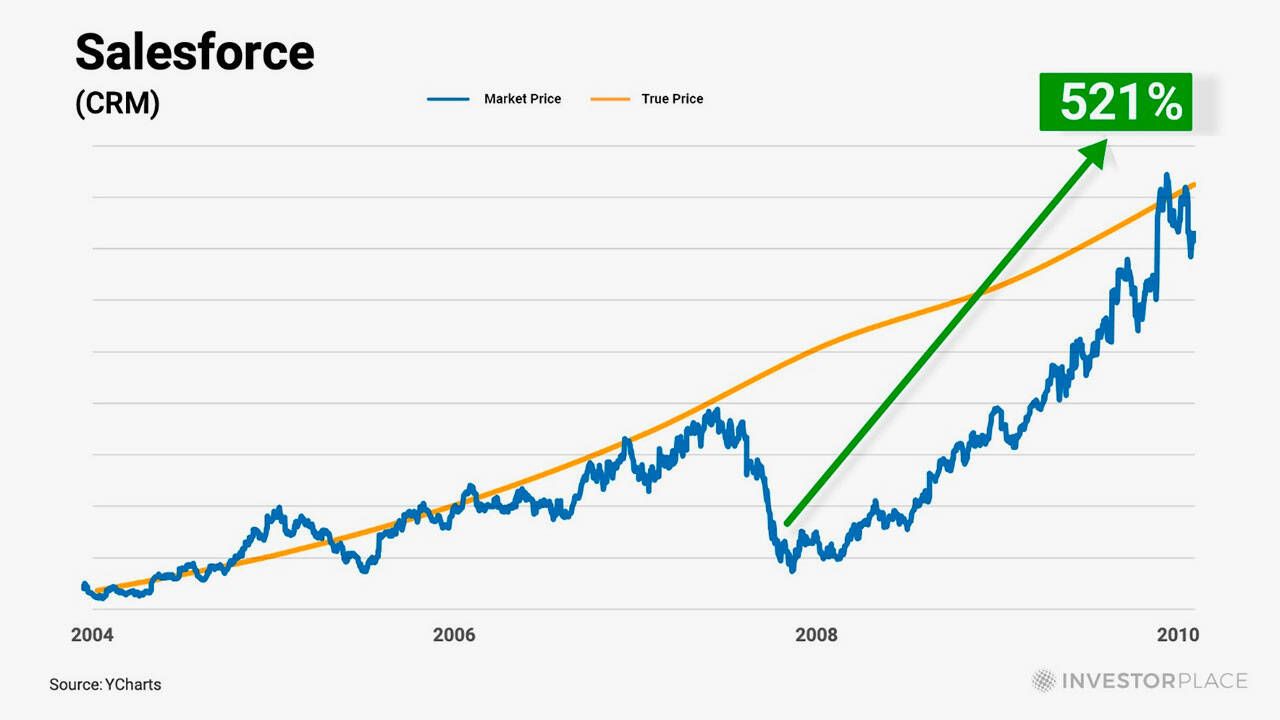

Luke mentions Salesforce (CRM) as an example of a divergent opportunity from the last big market crash in 2008. During that market crash, Salesforce stock plummeted, marking a big departure from its “true” value.

Over the next two years, however, Salesforce’s stock shook off the market conditions, and the stock returned to its true price.

If you had purchased Salesforce during this diversion period, you would have earned huge returns on investment. You spotted a divergence between the true value of a stock and its current trading price, and you bought at that unsustainably low price.

A number of other stocks had similar stories during the last recession, temporarily dropping in value before rising considerably to reach new highs. Other examples shared by Luke Lango include:

Booking Holdings (BKNG) fell 66% in less than a year during the recession, only for the market price to snap back to its true price and bring huge returns; the stock doubled within 6 months and soared 791% in 24 months

The S&P 500 index overall took 5 years to reach new highs; it wasn’t until 2013, five years after the 2008 collapse, that the S&P 500 surpassed its previous high set in 2006/2007

Google snapped back after the last recession, delivering 122% gains in 12 months for those who bought during the depths of the 2008 recession

Apple (AAPL) rose 171% in 12 months, while Netflix (NFLX) rose 202% in 12 months, providing investors with triple the returns

These are some of the best divergent stocks Luke identified from the 2008 recession. However, he went back to the 1987 crash and “Black Monday” and found similar stories. Investors who bought Oracle (ORCL) during the crash would have made 188% as the stock snapped back, for example. Meanwhile, investors who bought into the S&P 500 index in 1987 would have earned 37,734% gains.

Luke Lango believes we’re seeing similar conditions in today’s markets – and these conditions could create huge opportunities for investors.

How to Find Undervalued Stocks in Today’s Bear Markets

Luke Lango’s approach isn’t crazy: his goal is to find undervalued stocks in today’s bear markets. By buying a company at its low and selling it at its high, you could make huge returns on investment.

However, Luke uses a specific, proprietary system to identify the most undervalued stocks on the market, then time those stock purchases for maximum returns.

Here’s how Luke Lango’s divergent system works:

Luke studied at Caltech, one of the world’s top-ranked science and technology universities. While studying, he met some of the smartest minds in the world. Those minds, according to Luke, have helped him “identify the perfect buy-in points for these rare occurrences,” including divergent events.

Luke and his team spent 6 months analyzing every divergent event since 1987.

After running the numbers and spending endless nights working on the system, Luke created a system to “take advantage and potentially rake in massive profits” by timing the markets.

Specifically, Luke and his team created a “divergence magnitude” that quantifies the size of a stock’s divergence. It analyzes the gap between a stock’s true price and market price. The bigger the gap, the bigger the divergence – and the bigger the opportunity for investors.

Some stocks had divergence magnitudes that were 40 or higher, which means they were a good opportunity. Other stocks had divergence magnitudes that were 5 or lower, which means they didn’t present as good of an opportunity.

Some of Luke’s best opportunities have had divergent scores of 100 to 400, indicating a huge divergence between the value of the stock and the true price. These opportunities have the potential to deliver huge gains to investors.

By subscribing to Innovation Investor today, you can discover Luke’s latest investment recommendations based on his divergence magnitude score. Luke uses his proprietary system to identify opportunities in today’s markets. Then, he shares those opportunities with subscribers.

Luke Lango’s #1 Stock for the Fourth Divergence Event

The fourth divergence event is underway. Luke has used his proprietary system to identify the #1 stock for the fourth divergence event.

By subscribing to Innovation Investor today, you can discover Luke’s number one stock for the fourth divergence event.

Luke Lango teases information about his recommended stock like:

The stock is Luke’s #1 stock for the fourth divergence event, indicating he believes it could deliver bigger returns to investors than other divergent stocks today

Luke’s divergent indicator shows a divergence magnitude of 177, indicating the stock is poised for a huge snapback over the next 12 months

Luke is “expecting 100% returns, minimum” on the stock

The stock isn’t just a temporary, short-term hold; Luke describes it as “one of my favorite long-term buy & hold opportunities, period”

In fact, Luke claims if someone held a gun to his head and forced him to buy and hold one stock for the next 5 to 10 years, he would pick this stock “without hesitation”

The company is radically changing one of the most important sectors of the American economy, and the company’s products and services could change many things about our day-to-day life

The company is a fast-growing fintech compony disrupting the legacy banking process, solving various problems in the legacy financial space – including account fees, poor customer services, and transaction fees

For all of these reasons, Luke Lango believes this company will be the “Amazon of Finance,” providing significant disruption ion a space that sorely needs it. In fact, Luke claims the stock’s latest sell off is “The most irrational sell off I’ve ever witnessed.”

SOFI Technologies (SOFI) is Luke Lango’s #1 Recommended Divergent Stock

Luke reveals his recommended divergent stock upfront without requiring you to subscribe.

By watching the presentation through to the end, you can discover the name and ticker symbol of Luke’s recommended investment.

Luke is a big fan of SOFI Technologies as a general investment. However, it’s not quite the best divergent stock opportunity. Other stocks have had bigger divergent magnitudes, according to Luke’s proprietary system.

By subscribing to Innovation Investor today, you can discover additional stocks that could deliver huger returns for investors as they snap back to their “true value” over the next few months.

Other Recommended Divergent Stocks

Luke Lango’s proprietary system has identified other divergent stocks that appear to have a huge separation between their current price and their true value.

By subscribing to Innovation Investor today, you can discover the names and ticker symbols of other stocks with an even larger divergent magnitude.

In fact, Luke believes these recommended stocks could deliver 100% to 5,000% gains in the near to medium term, including:

- 100% to 300% gains within the next 12 months

- 1,000% to 5,000% potential in the medium term

Over the long-term, Luke believes these recommended stocks present a “probable opportunity to build generational wealth. Not once, but three times over.”

To discover the specific stocks Luke recommends buying today, you need to subscribe to Innovation Investor. All new subscriptions come with a bonus report called The Fourth Divergence: Three Companies That could Snap Back 100% Or More in Next 12 Months.

In the report, you get full details about each of Luke’s recommended stocks, their divergent scores, their ticker symbols, and why Luke believes they’re a good short-term and long-term investment opportunity.

How Does Luke Know the “True Price” of Stocks?

Luke Lango’s proprietary system involves identifying undervalued stocks. These stocks have a big difference between their current trading price and their “true price.” Over time, these stocks should rise back to their true price, presenting investors with a huge opportunity.

So how does Luke Lango know the true price of stocks? How can Luke consistently identify undervalued stocks?

Luke claims his proprietary system identifies the true price of stocks. He claims to have spent hundreds of hours over the last six months developing a proprietary system to identify the true price of stocks and time the market optimally, giving investors minimum risk and maximum reward.

By subscribing to Innovation Investor today, you get a report called True Price: The Secret to Finding Undervalued Companies in a Bear Market.

The report covers topics like:

- Everything you need to know about Luke Lango’s proprietary method for identifying the true price of stocks and timing the market

- How to use Luke’s system to find the best times to buy shares

- How this information can help you enjoy huge potential returns on investment in today’s divergent market conditions

Luke would not normally share this information with the world. However, because it’s only applicable during today’s “divergent” event, the information will only be useful for a short period. Luke is comfortable sharing this information to help investors make informed choices today.

What’s Included with Innovation Investor?

As part of a 2022 promotion, all Innovating Investor purchases come with a bundle of bonus reports. In addition to monthly issues of Innovation Investor, you receive immediate access to Luke’s recommended divergent stocks and more.

Here’s what you get when you subscribe to Innovation Investor today:

Monthly Issues of Innovation Investor: Each month, Luke Lango shares new investment opportunities with subscribers, including specific stock recommendations, market analyses, and more.

Bonus Report #1: The Fourth Divergence: Three Companies That Could Snap Back 100% or More in Next 12 Months: Luke has created a proprietary system that tracks “divergences” between the true value of a company and its current stock price. During a bear market, there are many divergences that could deliver huge returns for investors. In this report, you can discover three of Luke’s most recommended companies, including three companies that could double in price in the next 12 months.

Bonus Report #2: True Price: The Secret to Finding Undervalued Companies in a Bear Market: In this report, you can discover how Luke’s proprietary system identifies the “true price” of companies, helping him identify undervalued companies in bear markets. Luke claims to have spent months developing the system with a team of engineers. This report breaks down how the system works.

Bonus Report #3: The Divergence Portfolio Purge: After a recession, some stocks snap back and rise to their true value, delivering huge returns for investors. However, other stocks never recovered. Luke’s system has identified several stocks whose plunge actually matches their true value. They have a low divergence score. Luke recommends selling these stocks now as part of a “divergence portfolio purge,” helping you protect your portfolio from plummeting prices.

Bonus Report #4: The Project Titan Prospectus: How to Cash in on Apple’s Next Potential Trillion-Dollar Product: Apple is developing something called Project Titan. Anyone can buy Apple stock to get in on this technology. However, Luke claims to have identified a key supplier for Project Titan. By buying this small company today, you could enjoy “40X gains in the next few years” after the deal goes public. Anyone who gets in early, before the Apple partnership is announced, could earn huge returns. In this report, Luke explains what Project Titan is and how to invest in the supplier today.

Innovation Investor Daily Notes: In addition to a monthly newsletter, Luke offers a daily newsletter with daily breakdowns of stock market action, updates to the model portfolio, and other insights into today’s conditions.

Access to Innovation Investor Concierge Team: Your subscription includes access to the Innovation Investor customer service team. They’re available 9am to 5pm EST Monday through Friday.

Bonus Special Mystery Gift: This gift is normally locked behind a $2,999 paywall. However, Luke Lango is confident this gift will give you a chance to capitalize on the team’s best investment ideas. You get this gift free of charge through the Innovation Investor online ordering form today.

Innovation Investor Pricing

Innovation Investor is priced at $29 to $49 for the first year of your subscription, depending on the offer you choose. That’s a 75% to 85% discount off the normal retail price of $199 per year.

Here’s how pricing breaks down:

- 1 Year Subscription to Innovation Investor: $49

- Depending on your ordering form, you may see the offer as low as $29 for your first year.

You can cancel your subscription at any time, and all subscriptions have a 365-day moneyback guarantee.

Innovation Investor Refund Policy

Innovation Investor is backed by a 365-day moneyback guarantee.

You can request a complete refund on your purchase within 365 days if you’re not satisfied for any reason. You can even keep the bonus reports.

About InvestorPlace

InvestorPlace is a financial publishing company based in Baltimore, Maryland. The company offers a range of free and paid subscription-based financial services, including Luke Lango’s Innovation Investor.

You can contact the InvestorPlace team via the following:

- Phone: 800-490-1846

- Email: feedback@investorplace.com

- Mailing Address: 1125 N. Charles St, Baltimore, MD 21201

Along with being an accomplished stock picker, Luke Lango is the Senior Technology Analyst at InvestorPlace.

Final Word

Innovation Investor is an investing newsletter led by popular stock picker Luke Lango.

Luke uses a proprietary system to identify divergent investment opportunities in today’s markets. Luke claims today’s markets are in a “fourth divergence” situation that presents huge opportunities to investors.

As markets fall, some companies get dragged down – only to rebound a few months later. When you subscribe to Innovation Investor today, you can discover the companies Luke believes have the best chance of snapping back over the coming months.

To learn more about Innovation Investor or to subscribe to Innovation Investor today, visit the official website. Annual subscriptions are available for just $29 to $49 for your first year and backed by a 365-day moneyback guarantee.