Society has a habit of constantly reminding us that trying to get wealthy by saving money is futile. Over time, inflation alone devalues wealth, preventing people from retiring comfortably. Wealth creation is possible either through entrepreneurship or investments. For individuals who lack the entrepreneurial spirit, investing in businesses with enormous potential will at least guarantee a share of the action. This brings up a crucial issue: Which asset type is most growth-bearing?

Time, geopolitical challenges, the economy, and what we need to survive are actually the deciding factors. There have been many original ideas, but only the strongest appear to last. How does one find investment opportunities in an ever-changing world? It might be useful to hear the opinions of investment analysts. This is where The Motley Fool Stock Advisor might come in handy.

What is The Motley Fool Stock Advisor?

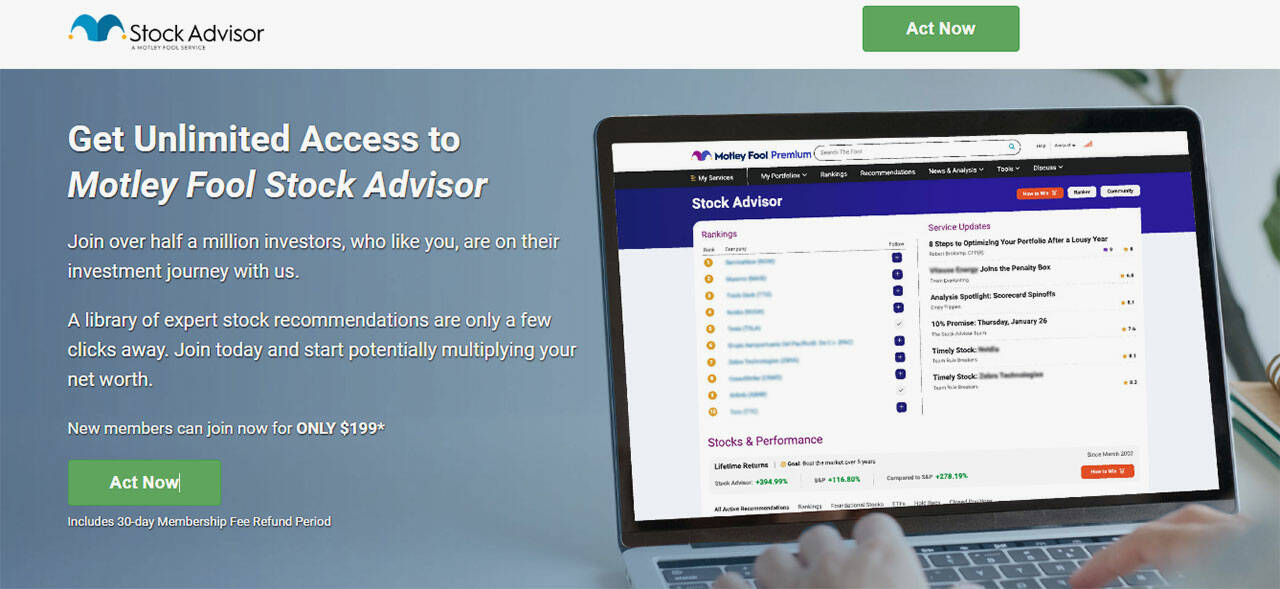

The Motley Fool’s flagship service, Stock Advisor, provides investors insight into stock research and recommendations. This service is entirely online and is ideal for both new and experienced investors. The Motley Fool’s analysts allegedly use this service to shed light on companies across the globe worth investing in. As for investing philosophy, Stock Advisor embodies a combination of diversification and intermediate- to long-term holding. Precisely, the team typically advises investors to hold 25 stocks for at least five years.

Since its inception, Stock Advisor has reportedly either kept pace with or outperformed the S&P 500. If the last couple of years have demonstrated anything, it is the unpredictability of the stock market, so having a team of specialists handle the legwork is useful in many ways. Unlike other services of this nature, Stock Advisor stands out because it has over 500,000 members and is still growing. What is it that drew these people to Stock Advisor? This is exactly what we will discuss next.

Dive into the world of stocks with Stock Advisor today!

What will I get out of The Motley Fool Stock Advisor?

Investors who join The Motley Fool Stock Advisor will be introduced to:

A user-friendly website where members can access two new stock recommendations delivered monthly;

Top 10 timely buys selected from a basket of over 300 stocks;

Foundational stock recommendations for new and experienced investors;

Access to a private, members-only platform for collaborative learning and applications, and a library of stock reports and other educational resources;

A collection of published content, including full articles and videos;

Take control of your financial future with Stock Advisor!

How much does a membership to The Motley Fool Stock Advisor cost?

It is determined by the type of membership desired. Individuals can currently pick between a one-year Stock Advisor or a one-month Stock Advisor membership, which cost $79 yearly and $39 monthly, respectively. The year-long subscription clearly has better value, as each week costs $1.52, and the service itself is backed by a 30-day money-back guarantee.

As with any financial service, users must assess their value and suitability for their own financial objectives. Members who are dissatisfied with the underlying methodologies that Stock Advisor is founded on or the recommendations themselves have 30 days from the date of purchase to ask for a refund. Put differently, the yearly subscription is more or less risk-free, seeing how the money-back guarantee doesn’t apply to monthly memberships. For the particulars of the refund policy, contact customer support via:

- Email: membersupport@fool.com.

- Phone: 1 (888) 665 3665

Unlock high-performing stocks with Stock Advisor!

The Motley Fool Story

The Motley Fool provides free and premium investment guidance in the hopes of making the world “smarter, happier and richer.” Their products are designed to assist average people in achieving their financial goals, which include long-term investment in innovative companies. This team has received a lot of praise up to this point for their timely market insights, in-depth company analysis, live streaming videos, free market news and commentary, and a variety of portfolio-building tools (depending, of course, on the service). The Motley Fool has offices not only in the United States but also in Australia, Canada, and the United Kingdom.

The Motley Fool’s backstory dates back to 1993 when brothers, Tom and David Gardner printed newsletters in their backyard shed in Alexandria, Virginia. A year later, The Motley Fool name spread thanks to an April Fool’s joke that served as a financial education tool. For those who are curious about the name’s origin, it comes from William Shakespeare’s play “As You Like It.” Specifically:

“The court jester, known as the Fool, could speak the truth to the king and queen without having his head lopped off. The Fools of yore entertained the court with humor that instructed as it amused. More importantly, the Fool was never afraid to question conventional wisdom.”

The aforementioned is used by The Motley Fool as their investing strategy, i.e., the team strives to speak just the truth and offers advice in this way to people of all backgrounds.

Make smart investments. Join Stock Advisor now!

Concluding Remarks

Stock Advisor is an investment research service through which members can gain market and stock insights. The Motley Fool is praised and frequently used for all investment needs for a number of reasons. First, Stock Advisor has outperformed the market 3-to-1 by exploring an array of industries and giving every company a fair chance before brushing them off. Businesses that aren’t even on Wall Street’s radar normally emerge as the winners.

Second, nearly 180 of their stock recommendations have so far comfortably surpassed 100% returns, with many going as high as 500%. Third, this team places an emphasis on long-term investing. So, short-term, day, and swing traders hoping to make a quick buck won’t gain anything from Stock Advisor. If there is one thing that established investors of our time have consistently reiterated, it is that time spent in the market is the most important factor. Knowing that The Motley Fool team stands by this is comforting.

How is it possible for anyone to forget how many times this service provider is cited in news articles or on other media platforms? In fact, many individuals seek The Motley Fool’s outlooks on what the future holds for investment ideas. All of their services, including Stock Advisor, signify their authenticity, dependability, honesty, and inclusion, which explains a lot. To learn more about Stock Advisor, visit here>>>