By Morf Morford, Tacoma Daily Index

Bed Bath & Bankruptcy

Bed Bath & Beyond was founded in 1971 and for many years grew into an iconic, even dominant retailer with 1,550 stores.

It overexpanded in brick and mortar stores, didn’t respond well to new online shopping trends, and began a string of money-losing years in 2019. The pandemic only made their situation worse.

In a desperate move to survive, instead of conserving its money for working capital, the company tried to keep its stock price up by buying back its own shares, while it borrowed still more money. And more money. Since 2004, it spent $11.8 billion on stock buy backs.

Even though sales were shriveling, and stores were closing, for most of 2021, its stock traded at between $20 and $30 a share. Bed Bath & Beyond shares, which were selling at almost $6 as recently as February, were trading at 12 cents in mid-April.

Also in February, a hedge fund bought up about $360 million of convertible preferred shares in Bed Bath & Beyond. Lots of individuals must have as well.

For better or worse, hedge funds are exempt from the kinds of disclosures required of other financial companies. And their impacts are felt by all of us.

Bed Bath & Beyond is just one example of what has been called the “retail apocalypse”. Online shopping is killing Main Street. And the side streets. And every business between them. It’s a strange time.

In my neighborhood, all hours of the day, seven days a week, I see delivery vans. All different colors, sizes and companies.

The pandemic, of course, multiplied the online shopping experience – and made it something like normal. Or least unexceptional.

And when I do go to stores, I often find them nearly deserted.

Shopping online may be “normal” and even affordable and (sometimes) convenient, but it sure doesn’t do much for our neighborhoods and business centers. Or our sense of community.

I’ve never been a big fan of most strip-malls, but empty storefronts are even worse.

Goodbye Jenny Craig

Since 1983 Jenny Craig has dominated the weight loss universe.

The company credited its closure to “its inability to secure additional financing”.

Jenny Craig, like so many other brick and mortar stores, is just another casualty of shifting consumer preferences and the increasing online market in almost every arena.

Once a staple of suburban strip malls, Jenny Craig is expected to close many, if not all, of its 500 US locations and will shift to online sales.

Weight loss is still an issue for many of us, and, in some form, a viable business model.

Other weight loss programs and businesses are threatened with similar fates; it turns out that the factors that impacted Jenny Craig are also having a negative effect on Weight Watchers – among many others.

Not your father’s retail market

The internet has spawned a near infinite number of online and local specialized fitness guides and helpers creating an entire constellation of small but agile competitors.

These businesses and entrepreneurs, and dozens of others like them, for the most part, did what they were supposed to do. Business were formed and developed, met a need in the market, provided a service and, for a time, flourished in the marketplace.

To put it simply, the rules have changed and a whole set of tremors and fault lines have developed underneath what were once sound and solid business practices. From grocery stores to speciality shops, no one is safe from the ever-shifting market dynamics. These changes impact employment, career tracks, investment and, of course the pace and texture of our neighborhoods and urban centers.

The landscape moved

When the work from home movement corresponded with the shift to online shopping and streaming, everything else changed. Our public spaces emptied out, urban centers became abandoned – at least by those who could support them and keep them in business. To put it mildly, this has not been good for business. Or for our sense of community.

Many companies are reversing or at least setting limits on working from home. And some neighborhoods are coming back. Slowly.

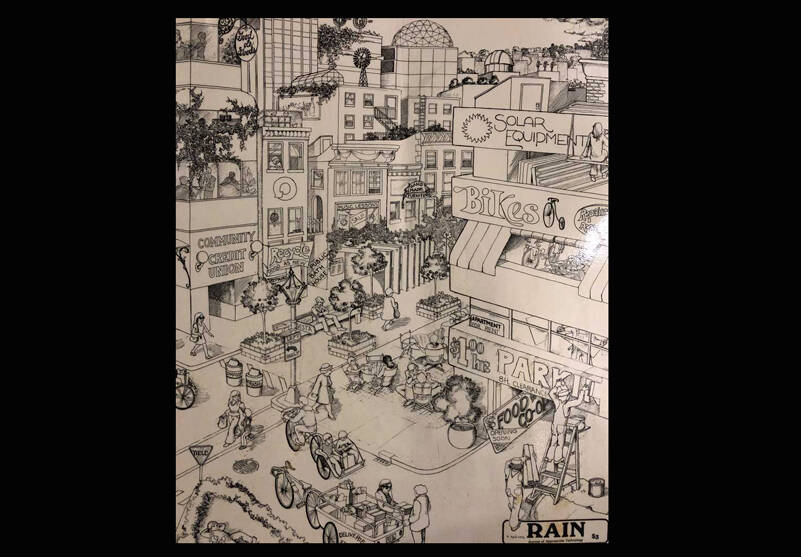

Small, innovative and inherently flexible, if not off-beat, businesses, most of them a mix of solid, local and street level, and online are preparing to fill the space left by shops and big box stores.

Perhaps the landscape has always moved. As the earth flexes beneath them, some businesses flounder or sink while others see and respond to previously unseen opportunity.

In short, what people want, and how they expect to find it – and in many cases how they pay for it – is not what many businesses, and many of us as individuals, are accustomed to.

For better or worse, there is no going back. The only way forward, is through…