Washington’s Democratic Gov. Bob Ferguson and Senate Republican Leader John Braun have teamed up to persuade voters to let the state make stock market investments with tax dollars collected for its new long-term care program.

Ferguson endorses a measure on the Nov. 4 ballot to amend the state constitution to allow assets of the program, known as WA Cares Fund, to be handled similarly to pension and retirement accounts. Any earnings would be plowed back into the program.

The governor joined five others, including Braun, of Centralia, to sign the voters’ pamphlet statement urging approval of Senate Joint Resolution 8201.

It is a “common sense measure that ensures tax dollars go further,” they wrote. It will “increase funding without impacting taxpayers” and “guarantee” benefits are there when individuals need them, it reads.

Four state lawmakers — a Democrat and three Republicans — penned the statement opposing the measure. They argue it would be “financial roulette” to put the money in “an unstable market.” Right now, “it’s safeguarded in secured investments like federal, state and municipal bonds which support our communities.”

Sen. Bob Hasegawa, D-Seattle, is one of the signatories in the opposition camp.

“You are betting that corporations will maximize their profits, which always come off the backs of working people,” he said. “It’s really cynical to gamble that corporations are going to win.”

The playing field

WA Cares is funded with a 0.58% tax on the paychecks of most workers in Washington. Beginning in July 2026, those who qualify can begin accessing the program’s benefit, a lifetime amount of $36,500 — a sum that is set to rise in future years to account for inflation.

Collections by the state began in July 2023. A person pays as long as they are working in the state. Deductions stop if they retire, become unemployed or leave the workforce, and resume if the person returns to work. As of March, $2 billion in tax collections had been banked in the program’s trust fund.

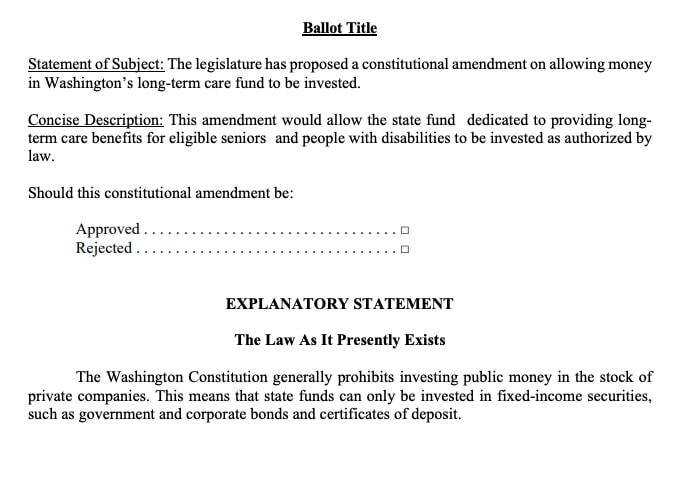

The state constitution generally bars investing public money in the stock of private companies. That means state and local governments are limited to fixed-income securities like government bonds and certificates of deposit that are less risky.

Senate Joint Resolution 8201, which passed by margins of 42-7 in the Senate and 86-9 in the House earlier this year, would add the Long-Term Services and Supports Trust account to the list of funds exempt from that prohibition alongside the state’s pension and retirement funds.

Voters defeated a similar measure in 2020 by a margin of 54.4% to 45.6%.

Those leading this year’s campaign said that they need to do a better job communicating that the Washington State Investment Board could produce higher earnings on WA Cares Fund assets that would translate into lower premiums and more benefits.

There were no lawmakers on the 2020 statement while the opposition had two — Hasegawa and the now-retired Republican state senator, Mike Padden.

Overall, the political environment is different, supporters said. The pandemic is over, the program is more widely understood and, last fall, voters rejected an initiative that sought to torpedo the program by making it voluntary rather than mandatory.

A campaign spokesperson said a recent internal polling found support in “the mid-50s.” At this point five years ago, the measure had only around 30% backing.

Those pushing the constitutional amendment note that some lawmakers who signed the opposition statement invest their money in the stock market.

Rep. Peter Abbarno, R-Centralia, who crafted the opposition statement with Hasegawa, is one.

“There is a big difference,” Abbarno said, “between a private individual who diversifies their portfolio versus a public official who invests somebody else’s money before knowing what the benefits will cost and what the exact design of the program will be. You have to be much more cautious when you have a fiduciary responsibility.”

Statements from both sides, along with an explanation of the measure prepared by the attorney general’s office, can be found on the secretary of state website.

Washington State Standard is part of States Newsroom, a nonprofit news network supported by grants and a coalition of donors as a 501c(3) public charity. Washington State Standard maintains editorial independence. Contact Editor Bill Lucia for questions: info@washingtonstatestandard.com. Follow Washington State Standard on Facebook and Twitter.