iTrustCapital is here to combine your IRA account with the booming world of cryptocurrencies. This crypto IRA provider makes it possible for you to trade that is buy and sell crypto using your retirement account.

Having an iTrustCapital account helps you better use the money in your retirement account. With the use of this crypto IRA provider, you can use your current IRA account and diversify your savings.

| Brand | iTrustCapital |

|---|---|

| About: | iTrustCapital is FDIC insured crypto IRA provider, that makes it possible for its users to trade cryptocurrencies with their retirement accounts. |

| Type of IRA needed: | It works with either type of IRA account by setting up a SIDRA account for you, which can be traditional or Roth IRA. |

| Founder: | Todd Southwick |

| Headquarters: | 18575 Jamboree Rd Suite 600, Irvine, CA 92612 |

| Website: | https://itrustcapital.com/ |

| Top Features: |

|

| Benefits: |

|

| Insurance and Custody: | iTrustCapital is insured by the Federal Deposit Insurance Corporation(FDIC) and has a custodial partnership with Coinbase Custody insured with $320 million. |

| Safety: | Makes use of SOC 2 Type II certified Fireblocks with an insurance backup cover of forty-two million USD. |

| Fees and Account minimums: |

|

In today’s article we will be taking a close look at what exactly is a crypto IRA, how does it differ from traditional IRAs or a Roth IRA. We will also be taking a look at how can also trade precious metals such as gold and silver using your iTrustCapital account.

So, without any further delay, let us take a look at what exactly is iTrustCapital and it can help you with your savings and provide you with tax benefits.

What is iTrustCapital?

iTrustCapital IRA is one of the best digital assets or crypto IRA providers out there today. With the help of an iTrustCapital crypto IRA account, you can use your diversify the savings in your retirement account or existing IRA account. It is a crypto IRA that lets you utilize all the tax advantages and tax benefits that you have with your existing IRA account, along with giving to the ability to buy and sell cryptocurrencies.

With iTrustCapital’s platform, you can pick between Traditional IRAs, Roth IRA(s), or SEP-IRA to get tax benefits on your crypto investments.

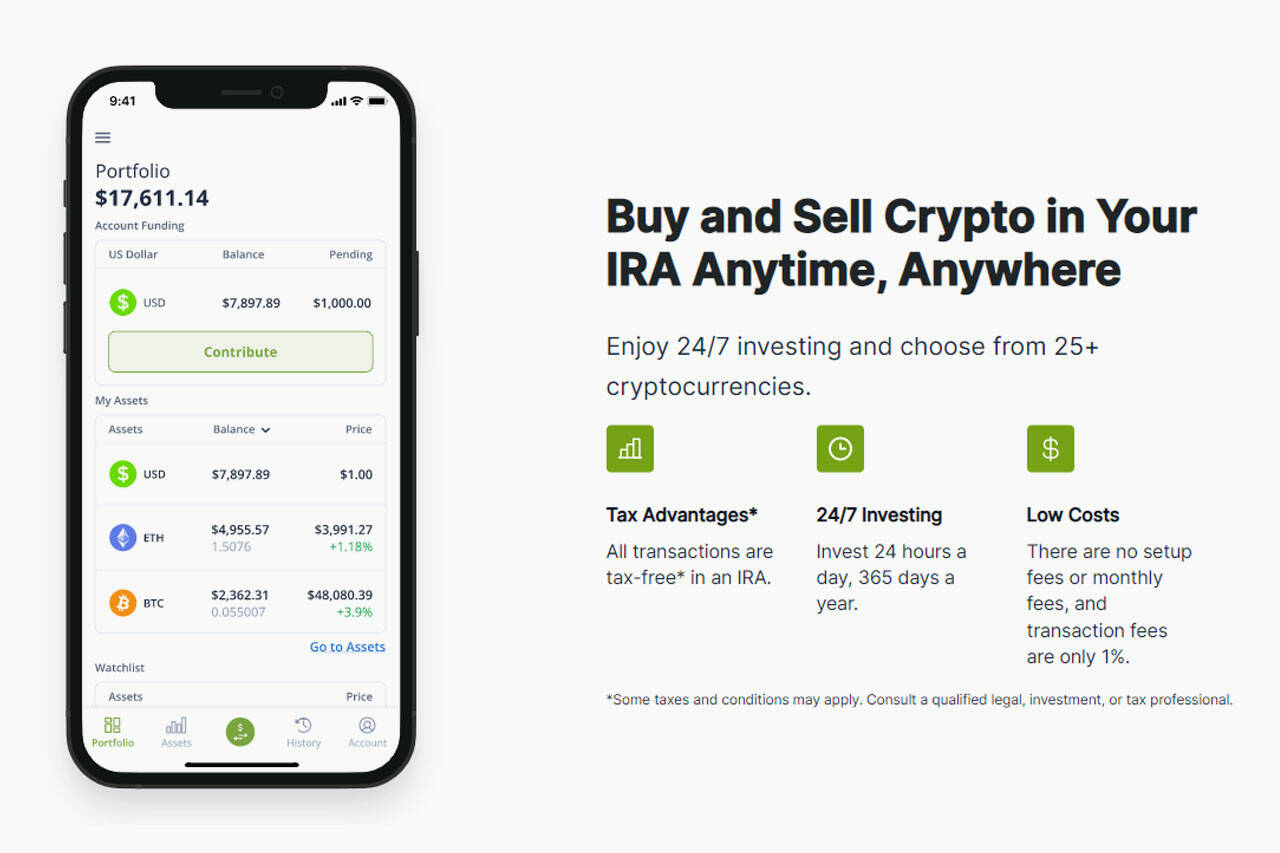

When you sign up and create an account with iTrustCapital, you are instantly eligible to buy and sell over 25 IRA-eligible cryptocurrencies. Additionally, iTrustCapital is the only crypto IRA service that lets you buy and sell precious metals. It lets you easily add gold and silver to your self-directed IRA account. This sets it apart from other cryptocurrency IRAs.

Also unlike any other cryptocurrency IRA broker, iTrustCapital is a crypto IRA provider that does not charge any monthly fees. It only takes a 1% convenience fee when you make any transfers or make transactions on their platform. Other than these transaction fees, everything else is completely free.

What exactly is an IRA? What are some different types of IRA accounts?

Before we talk more in-depth about why we think iTrustCapital is one of the best crypto IRAs and the features it offers, let’s take a quick second to look at some popular types of IRAs and where exactly crypto IRAs fit in this.

IRA stands for individual retirement accounts which, as the name suggests are retirement accounts to help you when you retire by providing you with tax advantages and tax benefits. Having an IRA account makes it easier for you to buy and sell various assets such as stocks and properties.

There are different types of IRA accounts that one can have but the two most popular types are Roth IRA and Traditional IRA.

Traditional IRAs are popular among a lot of people as they are very easy and straightforward tax-deferred accounts that are funded with pre-tax dollars. The contributions that you make to your traditional IRA are tax-deferred meaning your withdrawals won’t be tax-free as your investments aren’t taxed.

A Roth IRA on the other hand provides tax-free withdrawals post-retirement. A Roth IRA is funded by post-tax dollars which is why you can enjoy tax-free returns. Roth IRA sports more lenient withdrawal rules as compared to a traditional IRA. Earnings made via a Roth IRA account are tax-free instead of tax-deferred accounts.

Other types of IRAs include SEP IRA, Non-deductible IRA, Spousal IRA, and Self-directed IRA. A SEP IRA is more or less a type of a Traditional IRA while something like a self-directed IRA can be both a traditional IRA or Roth IRA. Self Directed IRA allows a person to hold more than just stocks and basic assets.

iTrustCapital IRA is a form of crypto IRA that can be tax-deferred or tax-free depending on what kind of IRA account you already have – traditional IRA or Roth IRA respectively.

A crypto IRA or cryptocurrency IRA is nothing but a tax-advantaged retirement account that allows you to hold, buy, and sell cryptocurrencies. Prior to cryptocurrency IRAs such as iTrustCapital cryptocurrency IRA, adding cryptocurrency to your existing IRA account wasn’t very possible. A crypto IRA lets you earn interest and tax-free or tax-deferred gains based on your IRA account type.

A crypto IRA or cryptocurrency IRA makes it easier for you to diversify your retirement portfolio. Diversification is a great way to safeguard your assets and ensure that you stay one step ahead of inflation. Cryptocurrencies such as Bitcoin, Ethereum, and bitcoin cash are rising exponentially today which is why having a crypto ira account is a good idea.

How Does iTrustCapital Work?

iTrustCapital lets you get started on your crypto IRA journey by setting up a SIDRA or self-directed IRA. You can choose your self-directed ira provider to be either a Traditional or Roth IRA.

With the help of your iTrustCapital crypto IRA account, you can add non-traditional assets such as cryptocurrencies and precious metals to your retirement portfolio. Once your account is ready and funded you can start trading crypto directly from the iTrustCapital platform.

To get started, you need to add funds to your crypto IRA account. You can add funds through 3 different methods:

- Transfer funds from your pre-existing IRAs

- Roll over funds from an existing employer plan (401k plans)

- Directly adding funds or creating new funds.

It is mandatory for any crypto IRA or cryptocurrency IRA to have a custodian that will hold your crypto purchases, as per IRS rules. To facilitate this, iTrustCapital is an institutional custody partner with Coinbase custody. Coinbase custody is the world’s leading cold storage provider and it also powers Coinbase. Coinbase ranks among the top and biggest crypto exchanges in the world.

How to Set Up an IRA with iTrustCapital?

You can get started with your crypto ira account with a free account on iTrustCapital’s platforms in just a few easy steps. They have step-by-step tutorials to help you guide through the process. To break it down into simple steps, all you need to do is:

- Create an account with iTrustCapital crypto IRA

- Select the type of IRA account

- Add funds to your account

- Start trading with cryptocurrencies, physical gold, and silver.

There are no setup fees or hidden account fees when you are first creating your crypto IRA with iTrustCapital. If you face any issues during this entire process the iTrustCapital platform support team is available to assist you and clear all your doubts.

iTrustCapital Available Cryptocurrencies

Cryptocurrencies are decentralized currencies backed by a secure blockchain distributed ledger. Cryptocurrencies were made to provide the world with a secure and decentralized form of money that isn’t controlled by any one entity, but rather is truly decentral, impossible to corrupt, hack, fake or manipulate.

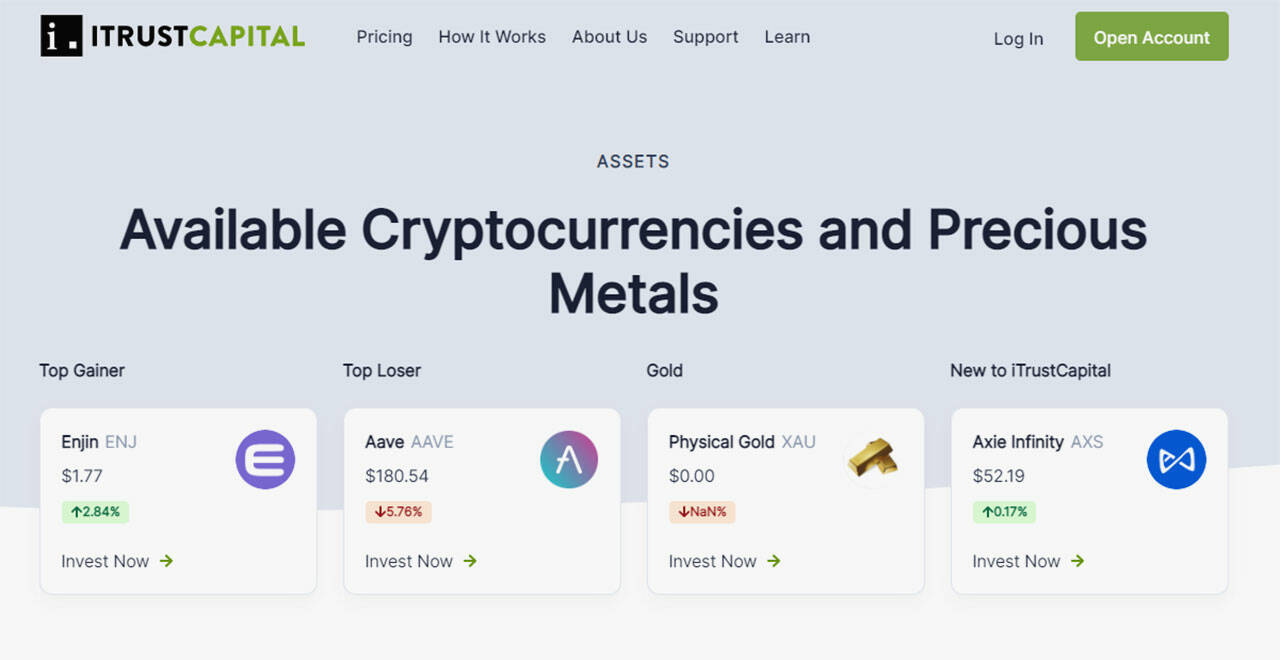

As of writing this report, iTrustCapital offers 29 crypto assets and 2 precious metals – gold and silver. You can buy and sell crypto easily with your retirement accounts, especially when using their Conditional Transactions, which allow users to plan out purchases. Here are the currently offered cryptocurrencies:

- Aave (AAVE)

- Algorand (ALGO)

- Axie Infinity (AXS)

- Basic Attention (BAT)

- Bitcoin (BTC)

- Decentraland (MANA)

- Shiba Inu (SHIB)

- Maker (MKR)

- Avalanche (AVAX)

- Ethereum (ETH)

- Chainlink (LINK)

- Polkadot (DOT)

- Litecoin (LTC)

- Dogecoin (DOGE)

- Bitcoin Cash (BCH)

- EOS (EOS)

- Stellar (XLM)

- Uniswap (UNI)

- Compound (COMP)

- Sushi (SUSHI)

- Yearn. finance (YFI)

- Polygon (MATIC)

- Curve DAO (CRV)

- Tezos (XTZ)

- Cosmos (ATOM)

- Enjin (ENJ)

- Cardano (ADA)

- Solana (SOL)

- The Graph (GRT)

This includes not just major blockchain-based cryptocurrencies such as BTC and ETH, but also Meta tokens, AltCoins, and a few meme coins as well. Additionally, there are also some Web3 tokens that are available for trading on iTrustCapital.

iTrustCapital Precious Metals

In addition to the above-listed cryptocurrencies, iTrustCapital offers a whole different asset class in terms of precious metals. With iTrustCapital, you can buy and sell two precious metals – physical gold and silver.

Precious metals have proven to be great alternative investments and now you can add them to your retirement investing plan. iTrustCapital deals with physical gold and silver trading and not with securities, futures, or bonds. This physical gold and silver come from the Royal Canadian Mint, which is a partner of iTrustCapital.

iTrustCapital Features & Benefits

There are many Crypto IRAs and iTrustCapital alternatives out there but what sets iTrustCapital apart from other crypto IRA platforms are its features which we will now be taking a quick look at.

Apply for an IRA Online in Minutes:

iTrustCapital makes it simple to open an IRA online in a matter of minutes. You can register a free account online at iTrustCapital.com with minimal effort instead of dealing with cumbersome paperwork.

Getting your account set up with iTrustCapital only takes a few minutes. You can then easily pick the type of IRA account you have and get started with your retirement investing.

Fund Your Account in 3 Ways

iTrustCapital is also comparatively more flexible than its alternatives when it comes to funding methods. When you sign-up for iTrustCapital crypto IRA, you need to add funds to your account.

You can do this in three easy and hassle-free ways. The first option is that you can directly transfer funds directly from any other IRA account that you may have. This also includes another crypto IRA or cryptocurrency IRA that you have without any liquidation.

Secondly, you can add funds by rollover from your existing employer plan if you are currently a salaried employee at a firm that offers 401k. 401k works in a similar fashion to a Roth IRA. Lastly, you can directly add funds but create a new fund specifically for iTrustCapital.

If you are confused about any of these processes, you can contact the iTrustCapital platform support team and they will help you out.

29+ Assets Available

iTrustCapital offers a lot of alternative assets, 31 to be exact. This not only includes major crypto tokens like Bitcoin (BTC) or Ethereum (ETH) but also popular altcoins such as bitcoin cash (BCH), dogecoin (DOGE), Solana (SOL), and more.

With the help of their platform, you can trade these crypto tokens 24 by 7 without any worry or you can swap them with physical gold and silver as iTrustCapital also offers two precious metals to help you even further when it comes to diversifying your portfolio. With Conditional Transactions, iTrustCapital allows the user to select the terms of their buying. Like a ‘limit-sale’ this gives the user the ability to sell or buy an asset at a price they set, without having to sit and watch for the price to drop or rise.

Coinbase Custody

iTrustCapital and Coinbase Custody are institutional custody partners. A crypto custody provider is necessary for any crypto IRA as it adds an additional layer of security. Coinbase is the world’s largest provider of institutional cold storage. SOC 2 Type II security certification is provided by Coinbase Custody. SOC 2 Type II is a certification is provided to a company that can successfully safeguard user data and control safety measures. All the iTrustCapital holdings are covered by a $320 million insurance policy, which makes them secure in case of any adversary. The Custody part of Coinbase is a separate, subsidiary organization from Coinbase. It is essentially a stand-alone fiduciary, that is backed by the New York State banking laws. The Custody has its own funds, and it uses a different set of asset storage procedures and protocols than CoinBase. The New York Department of Financial Services (NYDFS) regulates Coinbase Custody, which is run by Coinbase Custody Trust Company, LLC.

Gold and Silver from the Royal Canadian Mint

iTrustCapital keeps its IRA-eligible gold and silver at the Royal Canadian Mint’s safe vaults. The Government of Canada owns the Royal Canadian Mint, which is a Crown company. VaultChain is also used by iTrustCapital to store and manage its actual gold and silver.

Safety of Assets

To protect accounts and possessions, iTrustCapital employs a security technology called Fireblocks. To eliminate single points of failure, Fireblocks use a multi-layer security method. Fireblocks, just like Coinbase Custody is also SOC 2 Type II certified and has an insurance coverage backup of Forty-Two million dollars ($42 million).

In addition to this, iTrustCapital is a leading crypto IRA that complies with the security guidelines established by AICPA – American Institute of Certified Public Accounts. It makes use of multi-authentication protocols the likes of which are seen in the banking and military sectors. It also has other widely used personal account protections such as two-factor authentication to protect user accounts.

iTrustCapital Pricing & Fees

Many online iTrustCapital reviews have split opinions when it comes to their fees and account minimums. Some iTrustCapital reviews say that their account minimums are too high while some say that their free accounts are a great feature.

While many other crypto IRA providers have hefty monthly fees, monthly maintenance fees, and setup fees, iTrustCapital has none of that. iTrustCapital only charges per-transaction fees on the tractions you make. Here is a general cost breakdown of using iTrustCapital’s platform:

- Monthly Account Fee: $0

- Cryptocurrency Transaction Fee: 1%

- Gold Trading: $50 over spot per ounce

- Silver Trading: $2.50 over spot per ounce

- Account minimums: $1,000 to open an account

- Conversion Fee: $75 one-time fee to convert your old IRA account.

There are a few other crypto IRA providers that have no account minimums, but they have generally high monthly maintenance fees. In addition to the thousand-dollar account minimums, you can also make subsequent deposits which are set at a minimum of $500. Paying a monthly fee above-mentioned crypto IRA isn’t ideal.

Apart from the above-mentioned fees, iTrustCapital has no additional setup fees, monthly fees, or any other hidden fees of any sort.

What’s Included with Your iTrustCapital Account?

When you get yourself a new account with iTrustCapital, it includes all of the following things:

- Quick setup of your new IRA

- Easy and quick assistance in transferring, contributing, or rolling over funds to your crypto IRA.

- Information regarding IRS rules and tax reporting

- Unlimited storage with institutional custody partner – Coinbase

- Phone customer service assistance

- No additional or hidden fees

What are the Pros and Cons of iTrustCapital?

Pros:

- It is easy to use and set up and allows easy and quick trade of crypto assets, as smoothly as major cryptocurrency exchanges.

- Great customer support with live chat and phone customer service.

- Offers alternative assets in the form of physical gold and silver.

- Ability to directly transfer cryptocurrency from any other cryptocurrency exchange or crypto ira without having to transfer it into traditional currency.

- Conditional Transactions to help plan purchases

- No monthly fee or hidden fees, just pay a 1% transaction fee.

Cons:

- The account minimums are 1000 dollars.

- It does not pay interest on your crypto holdings, unlike some cryptocurrency IRAs.

- Limited range of cryptocurrencies.

About iTrustCapital

iTrustCapital is a crypto IRA that allows its users to trade cryptocurrency, physical gold, and silver, 24/7 with their retirement accounts that can be funded through old IRAs, rollovers from 401k plans, or by simply adding new funds by following yearly guidelines.

Founded in 2018, iTrustCapital is based in Irvine, California. It was founded by Todd Southwick with the goal of changing pre-existing and dated IRA models. Their aim at provide users and investors with a convenient, easy, and safe way of investing their retirement funds to trade with cryptocurrencies.

iTrustCapital has a custodial partnership with Coinbase’s custodial entity which is one of the largest cold storage institutions. Their physical gold and physical silver are kept at safe and secure mines of the Royal Canadian Mint, a Crown entity owned and run by the Government of Canada. All the funds stored in iTrustCapital accounts are Federal Deposit Insurance Corporation or FDIC insured.

iTrustCapital has a current market evaluation of 1.3 billion US dollars, which is a result of the 125 million dollars that were raised by them. Since its inception back in 2018, iTrustCapital has successfully processed over four and a half-billion dollars in terms of transaction volume.

There are many cryptocurrency IRAs available today, but iTrustCapital stands out among them because of their various features, safety and trustworthiness.

You can get started with your own crypto IRA with iTrustCapital in minutes with an account that is free to set up. But you do need $2,500 to get started with crypto and metal trading. The initial minimum that iTrustCapital allows currently is $1000. There is no subscription, set up, maintenance, or account fees of any kind.

iTrustCapital charges a 1% transaction fee per transaction on their platform, meaning, if you were to buy X cryptocurrency for $100, then you would have to pay $1 to iTrustCapital.

iTrustCapital does not pay interest on cryptocurrencies as of yet. It is available in all major US states but it does not operate in the States of New York and the State of Hawaii.

Final Word on iTrustCapital

So, is iTrustCapital legit? Yes, absolutely. iTrustCapital is a safe, secure, and trustworthy crypto IRA that is perfect for diversifying your retirement portfolio and capitalizing on the volatility of cryptocurrencies.

If you have any doubt regarding any of the features and services offered by iTrustCapital, you can contact their customer service reps on their website. The information in this article does not constitute investment advice in any way shape or form.

To learn more about iTrust Capital, be sure to visit the official website by clicking here! >>>