High or low, 2020 is going to be a tough year to beat

By Morf Morford

Tacoma Daily Index

Those of us paying attention to leading economic indicators (https://www.aaii.com/investing-basics/article/the-top-10-economic-indicators-what-to-watch-and-why) such as real GDP (gross domestic product), money supply, consumer price index, producer price index, consumer confidence, current employment statistics, retail trade sales and food services sales, housing starts, individual and national debt and a few other aspects of the economy, knew that 2020 was going to be a wild ride.

How wild it is turning out to be is exceeding anyone’s expectations.

COVID-19, and its repercussions, is hitting us far harder and with far more velocity, in terms of spread, than even the most diligent researchers would have expected. But even that illuminated the weaknesses of our system and our various supply chains – hitting us first with consumer items like groceries and toilet paper, and later with disruptions in the production of medical gear and then more standard durable goods like household appliances and vehicles.

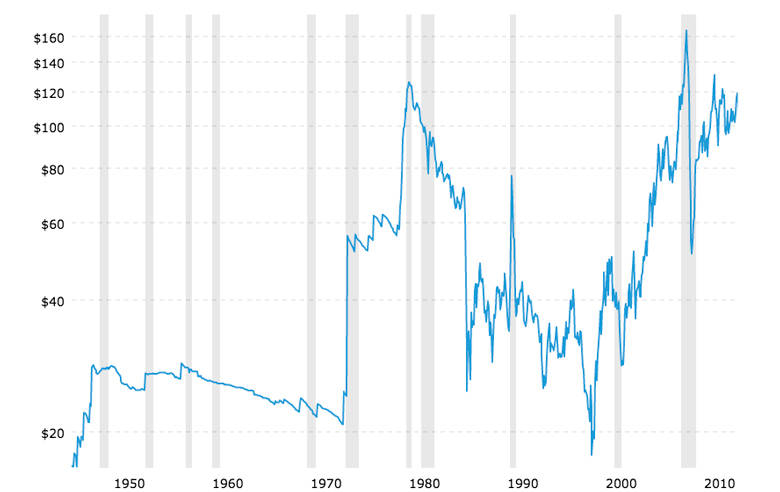

Factor in variables like the price of oil – as of the end of March, some oil industry experts are projecting a price as low as $10 dollars a barrel. (Interactive chart here – https://www.macrotrends.net/1369/crude-oil-price-history-chart).

What this would do to our economy is anybody’s guess – but turmoil and continuous disruption in many key industries can be expected.

Our economy is primarily a demand economy. To put it simply, our economy produces what customers demand. In other words, one person’s spending is another person’s income.

This works smoothly most of the time.

Supply and demand largely define the market price (which does not need to have any bearing on the production price or even whether any give item is legal or not. The “underground economy” and illegal markets as in drugs, piracy or human trafficking all strictly follow supply and demand principles).

The US economy is about 70% consumer driven. When customer confidence is high, the economy hums along, and as the economy expands and becomes more accessible to more workers, customers and producers, customer confidence becomes even stronger and the economy becomes even more solid. It is the ultimate virtuous cycle – one that seems inevitable and unstoppable.

Until it stops.

Be careful what you wish for

I know many people who voted for President Trump in 2016. They came from many different political perspectives. Some were traditional conservatives. Many had even been supporters of Bernie Sanders. But they all voted for Donald Trump for the same reason; he would shake up the system.

And he delivered. No system from our national parks to our postal service to our legal system, health care or our tax structure, and international trade laws among many others, bears much resemblance to its pre-2016 existence.

There’s an old saying that the stock market hates uncertainty. The standard market isn’t too wild about it either. For once, Wall Street and Main Street see things the same way.

So by the time 2020 rolled around, all the pieces were in play for an economy, for better or worse, like none of us have ever seen before.

Put all those ingredients in a cocktail shaker, add a dash of COVID-19, pour it in a glass and you have the economy of 2020.

Except it is much bigger than that.

It has been said, and certainly seems true, that Pierce County is the most trade dependent county in the most trade dependent state.

What happens a thousand – or five thousand – miles away happens here – sometimes very quickly.

Whether it is a virus or a new phone, we tend to get it first.

We have our fingers in a $87 trillion-dollar economy (and as a reminder; a million is a thousand thousands, a billion is a thousand millions and a trillion is a thousand billions).

This is a huge pie split millions, if not billions, of ways. And like the proverbial battleship, it lumbers along, gaining momentum and is seemingly impossible to stop.

Until it stops.

Toward the end of March, thanks to city – or even statewide – lockdowns, our service economy (restaurants, clubs, entertainment venues and hotels) essentially shut down literally overnight.

Americans spent $478 billion in 2019 on transportation (excluding personal auto costs) and $586 billion on recreation (sports, concerts and gambling) and over $1 trillion on food services and accommodations (restaurants and hotels).

That all adds up to a bit over $2 trillion – virtually all of which is expected to evaporate for at least the next few weeks.

Our faithful battleship economy is at a dead stop. At least in some areas – especially the service sector.

What it will take to get our ship moving again, and how long it will take, is something only time will tell, but for now, the fractures of our economy, like economic fault-lines, keep spreading.

Business revenues impact employee pay which impact spending which impacts taxes, which impacts city and school revenues which impacts rents and property values and community investments.

Everything that was a component of a virtuous cycle is now a player in a vicious cycle.

Closures lead to lay-offs, which lead to a drop, if not collapse in discretionary spending. Hotels, restaurants, bars, even airlines are shutting down. Some forever.

The service industry (airlines, restaurants and hotels) in 2018 employed almost 14 million full-time equivalent employees.

The vast majority of these have, or soon will apply for unemployment.

Delivery services are hiring these people, at least for now. Will they still be employed there six months from now? Probably not, but the airlines, restaurants and hotels that they worked for before will have trouble getting them back.

These individuals are in flux, but most of them can adapt quickly or revert to couch surfing and the gig economy to get by.

Those empty hotel rooms and mothballed airplanes are another story – they are investments rapidly turning into liabilities.

And at $10 a barrel (or even $50) who is going to invest in oil production?

Major companies and their investors, once the backbone of our consumer driven economy, are in trouble and in trouble like we have never seen before.

Remember those days immediately following September 11th, 2001? In spite of our national trauma, it didn’t take long for the economy to recover.

In August of 2001, Americans spent $26.9 billion in restaurants and bars. In September that number was $26.2

billion – only a drop of 2.3%. By December sales were higher than August – and stayed higher until the great Recession.

Our drop is already far higher, and the fractures far deeper, and no one thinks that by summer, or even by this December, we will be back to the levels of employment and income we saw just a few weeks ago.

We’ll get through this, but don’t expect any miracle cures for COVID-19 or the economy.