By Morf Morford, Tacoma Daily Index

Several years ago I read an absolutely fascinating article about the history of the baseball. I couldn’t find the original, but here is another great article. I was struck by the ability of a writer to take a mundane, much-overlooked, everyday item and give a fascinating analysis and history of a topic that, to put it mildly, is not of much interest to most of us.

I think the same holds true for interest rates. Most of us, I am convinced, think about interest rates much like we think of the weather; we just bear and make due with the current circumstances and, usually with a near fatalistic sense, hope that conditions improve.

Interest rates are a blunt instrument

At best, interest rates are a blunt instrument and the results of a rise, or drop, in interest rates are, at best, not terribly clear, and, in most cases, far from immediate. It usually takes about a year for interest rates to show their full impacts. And, as you might guess, a multitude of other factors might intervene over that same year.

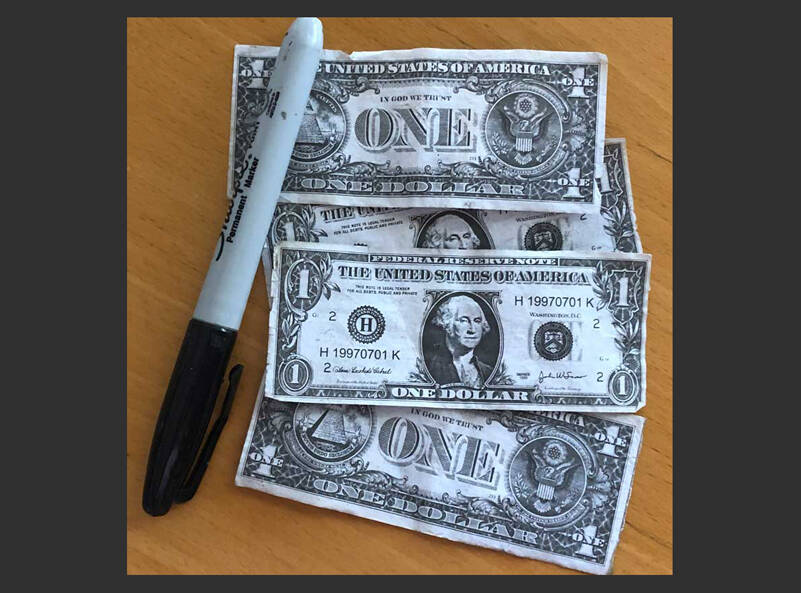

Interest rates are literally the cost of borrowing. How much it costs to borrow money directly impacts investment and potential expansion of a business. It also impacts the purchase price of items bought over time – from appliances to vehicles and property and homes.

In short, like the weather, interest rates impact us all. As always, some more than others, and some more negatively and some more positively.

In other words, interest rates affect calculations about the likelihood of future profitability. When interest rates are at historic lows, for example, it is far easier to enter the capital markets and finance new projects, but if interest rates are expected to increase, that same project might not be a money maker – or even an economic loss in the long term.

The economic seesaw

High interest rates also impact savings. Just a few years ago savings accounts paid about one percent interest – or less. Some savings accounts in mid-to-late 2023 pay about 5% – which means that a bank savings account just might pay more and be far more secure than a stock market investment.

Short vs long

In short, interest rates dictate the ever-shifting terms and balance between savers and borrowers. And virtually every one of us finds ourselves on one – sometimes both – sides of this economic equation.

Interest rates directly affect how much new bank loan money is circulating in the economy. If more of us put our money in interest bearing accounts, more cash is available for business or home loans.

There is no objective neutral, natural or “best” rate of interest; the interest costs and benefits depend on the physical supply and demand characteristics for each market.

If you have a purchase in mind which requires a loan, you can evaluate the long term cost here.

Low interest rates are great. No, high interest rates are better…

Way back in 2008, low-interest rates made borrowing for mortgages too easy. And many potential home owners took on more (usually far more) debt than they could handle. It also made long-term, capital-intensive projects, such as home construction, too easy to initiate.

In other words, home builders and home buyers became intoxicated on, and addicted to, cheap money. And much of the world economy wilted because of ineffective interest rate policies.

Among these disastrous policies were “variable” mortgages like interest-only loans. Under this plan, borrowers only paid the interest and, in many cases, never reduced the principal. This was marketed to first-time home buyers who longed to get out of renting, but could not meet standard mortgage guidelines.

The worst loan program of all was the negative amortization loan. In this system, the monthly payment was less than needed to pay off the interest. Instead, thanks to accruing interest, the principal on these loans actually increased each month. This meant that loans increased to the point that borrowers owed more than their homes were worth. The term “underwater” came into common use in the housing market about this time.

To sum it up, interest rates control the flow of money in any economy. Higher interest rates curb inflation but are likely to slow down the economy. If interest rates stay too high for too long, they can cause a recession, which creates layoffs as business growth slows. Lower interest rates stimulate the economy but too much money in motion usually leads to inflation.

In short, interest rates are a lot like the weather here; be prepared for anything and remember that no matter what happens, it won’t last forever.