By Morf Morford, Tacoma Daily Index

Something very strange happened in the business environment in the past twenty years or so.

A very specific, even revolutionary, business philosophy emerged in the mid to late 1990s.

It must have happened on a day when I, and most of us apparently, must not have been paying attention or maybe we all missed that day in class.

Way back in the Twentieth Century, a core assumption of business was very simple; one starts a business to make a profit.

Thanks to Amazon in 1997, that all changed.

If you had the (mis)fortune of owning Amazon stock back then, you know one thing – the stock price barely changed quarter after quarter – it finally crossed into three dollars a share (to stay) in early 2009. In other words, the stock price of Amazon barely changed in over twenty years. But that didn’t rally matter to the company.

That stock price now sits at about 140-150 dollars. But that stock price doesn’t really matter either.

And that once near-sacred benchmark, profitability, didn’t matter either.

Deliberately or not, Amazon changed the landscape of business and commerce we all inhabit.

More than 99% of businesses across the USA are small. And you could make the argument that 100% of businesses start small.

Of those businesses that begin, 20% fail in the first year, 30% in the second year and 50% by year five.

Of those businesses that fail within the first five years, more than 40% of them fail due to a lack of market demand. The second most common reason for small business failure is running out of capital.

In other words, if you start a business, you better be prepared to keep it going if the customers (and profits) don’t show up as expected.

It’s an Amazon world. We just live in it.

Amazon had a very different vision and set of intentions back then – market (if not world) dominance. Profit didn’t matter much – but market share did. If Amazon could only survive its first, and second, and fifth, and twentieth year, it would prevail.

And that seems to be the business model for businesses of all types in our current economy.

Back in the 1990s, Amazon’s intent to be “The Everything Store” was revolutionary, and they were essentially the only company that could, when it comes to shopping online, do it all.

But that was then, and in the 2020s, more and more companies are entering the “everything” market – and are prepared to lose money for the first, or second, or tenth year to attain the holy grail of success in today’s economy; market share.

Losing money “R” us

A foundational principle of pricing used to be “whatever the market will bear”. But that was then…

In today’s economy, price has become semi-negotiable, even porous. And the principle seems to be more like “whatever will get, and preferably keep, a customer”.

Looking beyond a single transaction, a smart company, or at least one that intends to survive, better look at that most elusive of customers, the one that purchases on a regular basis. A generation ago, the term for this was “loss-leader” – an item was sold at a loss to establish an enduring customer base.

Profit in any given transaction doesn’t really matter. Customer loyalty is what matters. Especially on a massive scale – both of numbers and years.

Quality retailers, like Nordstrom, have known this for decades, if not longer.

But emerging businesses need to make their presence, if not necessity, known and front and center to those willing to buy. Whether they make money or not. For the first, and second, and fifth, and tenth year. And beyond.

In the USA, 70% of businesses fail within ten years. And the typical business lasts a little over eight years.

Those that make it, especially those who make it big, do so, in most cases, thanks to market share more than profit.

The past few years have seen all kinds of entries of what could be called niche companies – with an eye for market dominance – often at the cost of short term profits.

Most of us, for better or worse, over the past few years, have shifted our shopping habits toward the online experience. Love them or hate them, those delivery trucks have become a regular feature in virtually every neighborhood.

Shop like a billionaire

I don’t really understand what “Shop like a billionaire” means, but I’m guessing that it means that you can afford anything that strikes your eye. This is almost entirely true of these two online shopping sites.

On the budget front, two companies have emerged in the past year or two that offer items at low prices – with multiple discounts (for first time users, purchases over a certain amount and other things) and, of course, free shipping.

Both of these sites are like Dollar Store on steroids.

Browsing on either site could take more time and money than you might imagine, but the products are, in most cases, unique, innovative and, of course affordable. And delivered to your door.

Shein

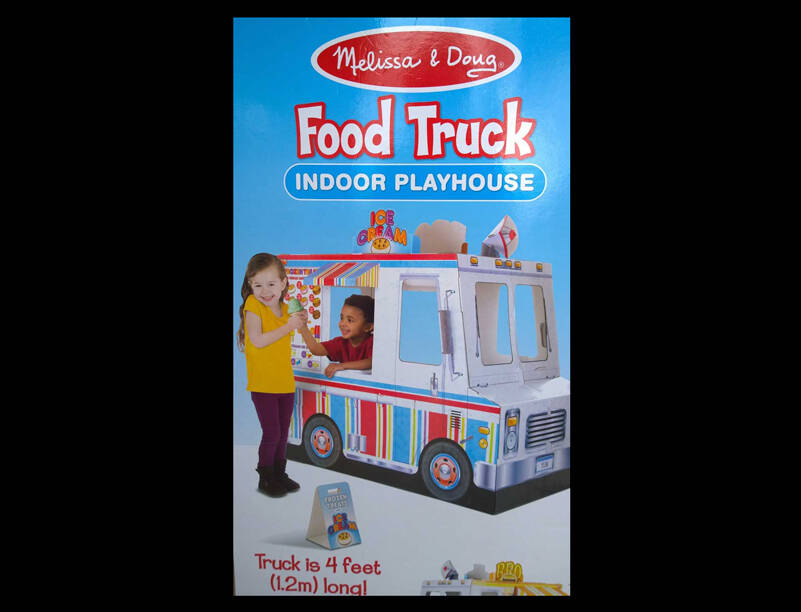

In time for the holidays, for an experience of affordable stocking stuffers and miscellaneous gifts, be sure to poke around the Shein website. Shein offers clothing, electronic gadgets, jewelry, toys and household items, among thousands of other unexpected products at great prices. For the fast-fashion fan in your family, this is a must-have account.

Temu

When it comes to tools, more household accessories than you could think of – from bicycle tubes to school supplies, it’s hard to compete with Temu.

Both of these sites are packed with things you didn’t know you needed – at prices your local brick and mortar stores could never match.

These sites, from Amazon to Temu, are terrible for local economies, but, whether we welcome or reject them, the market, of everything from books to vehicles, is nothing like it was.

If you have visions of starting your own business, both the landscape and survival strategies have shifted into territory of opportunity and hazard like never before.