Sound Transits cautious economic forecasting has protected it from the budget shortfalls facing many other jurisdictions in Washington, according to an agency financial analysis released last week.

In 2001, Sound Transit collected approximately $268 million in tax revenues, which is $5.93 million (2.26 percent) more than forecast in late 2000. (The agency also revised its forecast after the events of Sept. 11, compared to the revised forecast the agency collected $8.62 million, or 3.32 percent ore than forecast.)

For the 1997-2001 period (from the agencys creation to the present), tax revenues are $65.57 million (5.95 percent) above the original forecast / budget.

Even with the recession and the economic fallout from the events of September 11, Sound Transits forecasting methodology is performing very well, Kevin Phelps, Sound Transit Board member and Finance Committee chair, said.

He continued: Because of its conservative methodology, this is the fifth year in a row that Sound Transits actual revenues have exceeded its forecast. This is proof through performance.

Sound Transit receives its tax revenues from three sources: a retail sales and use tax, a motor vehicle excise tax (MVET), and a rental car tax.

In 2001, retail sales and use tax revenues were $2.64 million (1.27 percent) above the original forecast, an excellent performance because this revenue stream is very sensitive to the business cycle.

MVET revenues had the best performance of Sound Transits three revenue streams, with a positive variance of $3.56 million (6.76 percent) in 2001.

Rental car tax revenues were $262,000 (10.71 percent) below the original forecast in 2001, but this tax yields only about one percent of Sound Transits tax revenues.

Rental car tax revenues have suffered the most from the twin impacts on tourism and business travel of a recessionary economy and the Sept. 11 terrorist attacks.

The best news is that the agencys original revenue forecast anticipated – and correctly adjusted for – the recession that started in the second quarter of 2001, Phelps said.

Pierce had the best overall tax revenue performance among the subareas in 2001, with a positive variance of $2.57 million (6.32 percent).

More Stories From This Author

Here’s how child care oversight...

By Keelin Everly-Lang keelin.everly-lang@soundpublishing.com

Parks Tacoma-Meeting Notice

By Amanda Kahlke amanda.kahlke@tacomadailyindex.com

NO. 25-4-03066-3 -PROBATE NOTICE TO...

By Amanda Kahlke amanda.kahlke@tacomadailyindex.com

No. 26-4-00140-8 -NOTICE TO CREDITORS

By Amanda Kahlke amanda.kahlke@tacomadailyindex.com

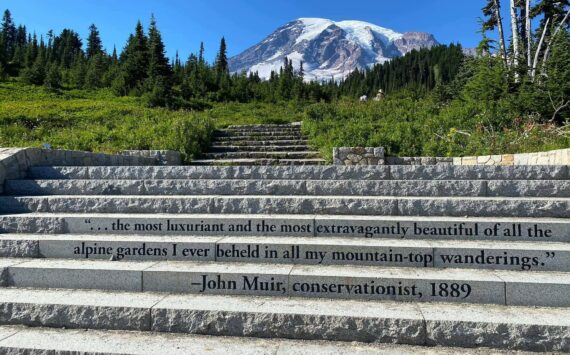

Mount Rainier no longer to require timed reservations

The program, implemented in 2024, aimed to spread out traffic and foot congestion as annual visitor numbers exceeded 2.5 million.

By Ray Miller-Still raymond.still@soundpublishing.com • January 22, 2026 4:40 pm

Here’s how child care oversight works in WA

How does oversight of child care spending actually work in Washington state?

By Keelin Everly-Lang keelin.everly-lang@soundpublishing.com • February 5, 2026 5:35 am

Bill seeks to update state’s involuntary treatment law

The Senate Law and Justice Committee held a hearing Feb. 2 for legislation that would make it easier to commit…

By Cassie Diamond, WNPA Foundation • February 4, 2026 5:30 am