Governor Chris Gregoire yesterday signed into law a measure that will close tax loopholes in the unemployment-insurance system and keep $1 billion a year in federal tax credits for Washington businesses. The new law targets employers who try to manipulate their unemployment tax rate by purchasing, restructuring or merging a business to get a lower rate. Similarly, $1.8 million in the supplemental budget was earmarked to increase efforts to detect and investigate fraud by employers and by unemployment claimants, and to collect unpaid taxes and invalid unemployment payments. The funding comes from penalties and interest collected from violators over the past year.

More Stories From This Author

Here’s how child care oversight...

By Keelin Everly-Lang keelin.everly-lang@soundpublishing.com

Parks Tacoma-Meeting Notice

By Amanda Kahlke amanda.kahlke@tacomadailyindex.com

NO. 25-4-03066-3 -PROBATE NOTICE TO...

By Amanda Kahlke amanda.kahlke@tacomadailyindex.com

No. 26-4-00140-8 -NOTICE TO CREDITORS

By Amanda Kahlke amanda.kahlke@tacomadailyindex.com

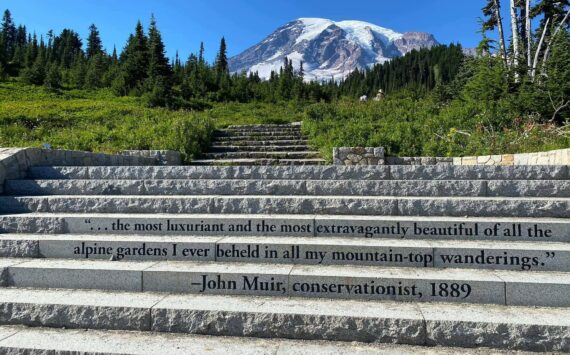

Mount Rainier no longer to require timed reservations

The program, implemented in 2024, aimed to spread out traffic and foot congestion as annual visitor numbers exceeded 2.5 million.

By Ray Miller-Still raymond.still@soundpublishing.com • January 22, 2026 4:40 pm

Here’s how child care oversight works in WA

How does oversight of child care spending actually work in Washington state?

By Keelin Everly-Lang keelin.everly-lang@soundpublishing.com • February 5, 2026 5:35 am

Bill seeks to update state’s involuntary treatment law

The Senate Law and Justice Committee held a hearing Feb. 2 for legislation that would make it easier to commit…

By Cassie Diamond, WNPA Foundation • February 4, 2026 5:30 am