By Morf Morford, Tacoma Daily Index

Most of us think of banks as architecturally solid buildings made of stone or brick and often with pillars and signs and symbols of security. And we expect them to be fiscally solid as well.

That might be why bank failures rule the headlines.

It might also be the scale of money involved. As one politician put it a few years ago, a billion here and a billion there, pretty soon you’re talking about real money.

I’m not sure what qualifies as “real money” with continually fluctuating interest rates and currency values around the world, but if such a thing exists, it should be held safely and securely in banks.

But so far in 2023, some banks are in trouble. And some of the banks in trouble are big. And some of the biggest banks are in the biggest trouble.

The cost of energy or food or building materials may swing erratically, but we Americans take it as a given that the dollar – and those who hold it – will be stable and prudent.

And maybe, to a large degree, they have been.

The failure of Silicon Valley Bank was followed by Signature Bank in March and then First Republic Bank became the third bank to collapse, the second-largest bank failure in U.S. history after Seattle-based Washington Mutual, which collapsed in 2008 amid the financial crisis that became known as the Great Recession.

FDIC to the rescue

In theory at least, most accounts are protected up to $250,000 by FDIC deposit insurance. But, according to a recent study, almost 190 banks across America are vulnerable. 190 multiplied by the number of accounts held and then again by $250,000 is, to use a phrase, “real money”.

Some are calling for increasing the limit on FDIC deposit insurance. Others are calling for its entire elimination.

The question, as with every transaction, is Who pays? And the second question is just as essential – Where does all that money come from?

Moral hazards “R” us

A few years ago, a common financial term was “moral hazard” – when one’s guiding principle is to not reward risky or irresponsible financial behavior.

What kind of financial behavior is encouraged or even motivated by FDIC deposit insurance? Does FDIC protect? Or just enable?

Should we get rid of deposit insurance? Deposit insurance, like every other kind of insurance, seems prudent. Even essential. But is it? And does it lead to the intended results?

It would be easy to make the argument that if you want irresponsible behavior in banks – often to the point of crisis – just lubricate the system with endless dollars to “rescue” banks from equally endless irresponsible behavior.

From multi-million dollar salaries for CEOs to dubious investments, banks have been using their (our) assets for purposes that are not always in our best interests.

The question to ask of any “solution” is whether it actually solves the problem, or, as in too many cases, makes the problem far worse.

If you consider FDIC protection essential for a stable banking system, consider this argument for the elimination of ANY deposit insurance.

So what’s happening in our banks?

One big thing happening in our banks is changing interest rates.

You don’t need to be a financial wizard to realize that years of low (near zero) interest rates followed by the greatest increase in rates in decades would catch some of us with assets tied up in low interest accounts suddenly being saddled with high interest expenses. In other words, some assets declined dramatically in value, while some assets (and many costs) increased just as much.

Banks, as we all know, invest their (our) assets. And the vast majority of those assets are/were long term, low interest. And as rates increased, account holders withdrew their assets and looked for better rates. Which led to bank runs like most of us have only seen in the movies.

And the banks lost assets. And investors. And credibility. It’s not far from a landslide that starts small and becomes an uncontrollable avalanche.

As you might guess, bank failures are not a positive economic sign.

In essence, money flows, as it always does, from not-so-healthy banks to stronger, healthier ones. One would presume that healthy banks are healthy because they have more solid policies. That is probably mostly true. In most cases then, a healthy bank (or banking system) will not have, or be susceptible to, the problems of not-so-healthy banks.

Back in the Great Recession (2008-09) while US banks and investment houses were struggling, if not collapsing, Canadian banks and investment companies prospered. While US banks were giving massive home loans to NINJAs (those with No Income, No Job and No Assets) Canadian banks did all the boring stuff – like requiring credit checks, references and income stability.

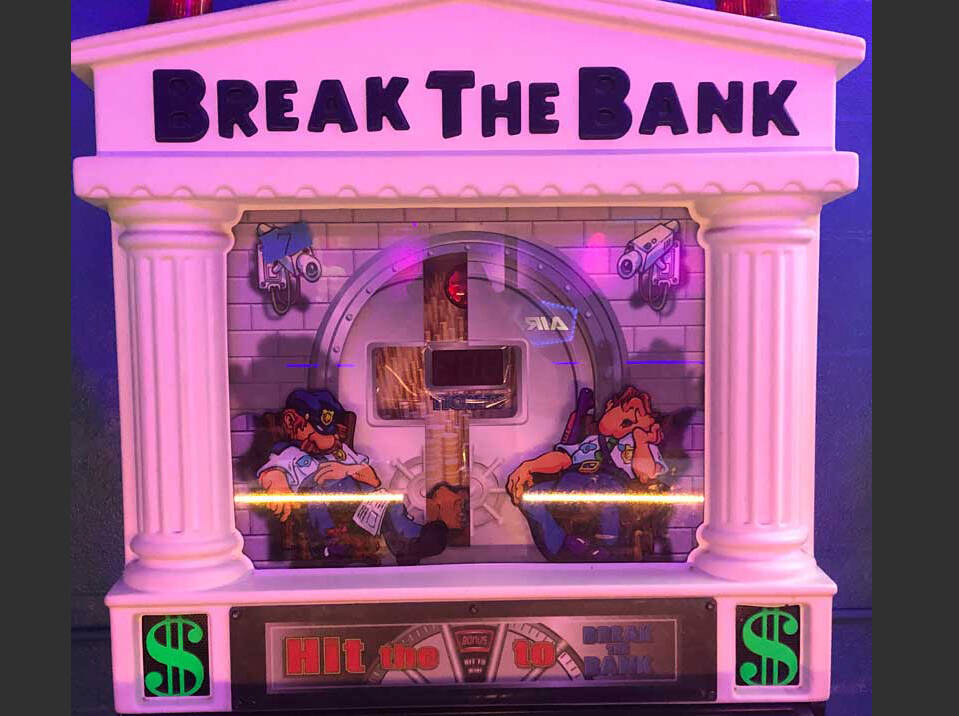

Banking should not be exciting or risky. The stock market may, at times, resemble a casino, but a bank never should. Banks and banking, above everything else, should be boring.